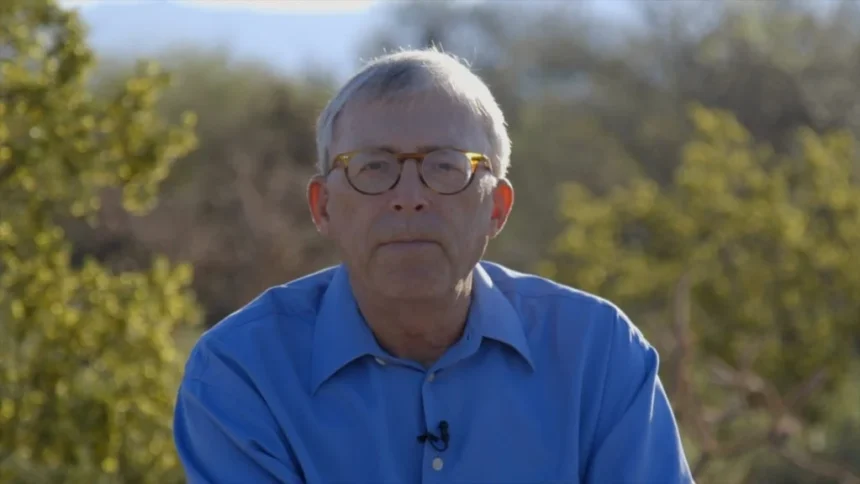

Renowned trader Peter Brandt has issued a warning to investors about the risks associated with cryptocurrency staking, especially with the recent launch of Ethereum ETFs. This announcement, made on May 25, 2024, has stirred discussions in the cryptocurrencycurrency community.

Brandt’s caution focuses on the inherent risks in staking cryptocurrencycurrencies like Ethereum (ETH) and Solana (SOL). According to him, staking, which involves locking up cryptocurrency assets to earn rewards, can expose investors to significant financial dangers. He compared staking to leveraged trading, where the potential for losses is substantial. Brandt emphasized that many investors might not fully understand these risks, which could lead to severe financial repercussions, including bankruptcies.

Brandt also pointed out that regulators might soon turn their attention to staking practices. He suggested that stricter regulations could be on the horizon, potentially complicating the staking landscape further. This regulatory uncertainty adds another layer of risk for investors who participate in staking activities.

Impact of ETFs

The recent approval of multiple-spot Ethereum ETFs has brought additional attention to cryptocurrency staking. ETFs, or Exchange-Traded Funds, allow investors to buy shares that represent Ethereum without directly holding the cryptocurrencycurrency. While this development is seen as a step toward mainstream acceptance of cryptocurrency assets, Brandt warns that it could also lead to increased speculation and volatility in the market. This environment, he argues, makes staking even riskier.

Brandt’s warning has sparked a lively debate within the cryptocurrencycurrency community. Some investors appreciate his candid advice, while others believe he might be overly cautious. Nonetheless, his status as a respected figure in the trading world means that his warnings are taken seriously.

Despite Brandt’s warnings, many platforms are moving forward with staking services. For example, Robinhood plans to list the spot Ethereum ETF and offer Solana-staking products to its European users. These platforms aim to provide more opportunities for investors to participate in the cryptocurrency market. However, Brandt’s caution serves as a reminder of the potential pitfalls that come with these opportunities.

Also read: Coinbase Collab with Compass Coffee for Crypto Payment Integration