In a stunning development for the meme coin market, a big holder of PEPE tokens has made waves by selling a huge chunk of their assets. This move has caused quite a stir in the crypto community and has raised new concerns about the stability of the market.

Whale’s Recent Moves Shake the Market

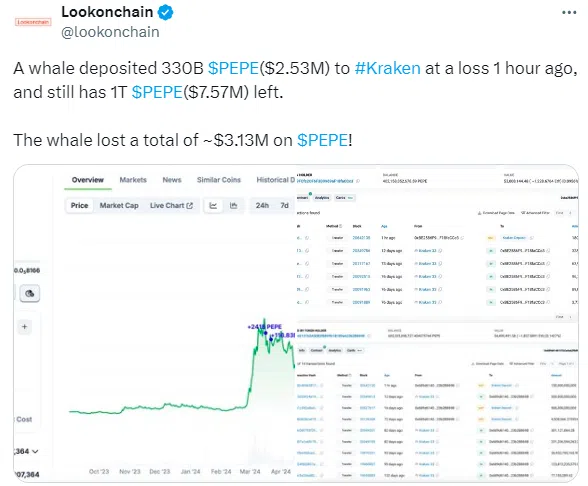

Recently, a well-known PEPE whale has made headlines by offloading $2.53 million worth of PEPE tokens. According to Lookonchain, this whale sent 330 billion PEPE tokens to the Kraken exchange. Even after this massive sale, the whale still holds a hefty 1 trillion PEPE tokens, worth around $7.57 million.

This sale was part of a series of transactions. First, the whale put 500 billion PEPE tokens up for sale. Later, they bought 828 billion tokens at a lower price. These trades increased their total holdings to 1.3 trillion PEPE tokens, which are roughly valued at $9.9 million.

Despite these actions, the whale has ended up with a significant loss of $3.13 million. This highlights the risky nature of trading in such volatile markets.

The Ripple Effect on the Market

The moves by large holders, or ‘whales,’ can greatly impact the overall crypto market. Big trades can lead to major price swings. In this case, the whale’s decision to deposit a large number of PEPE tokens on Kraken likely created a lot of selling pressure on the market.

This situation is especially worrying given the current market conditions. The broader cryptocurrency market has been in a decline, with Bitcoin dropping below $59,000 before a slight rebound. Ethereum and Solana have also seen their prices fall. This ongoing bearish trend has added to the market’s instability.

Currently, PEPE tokens are priced at $0.00000778. This is a slight increase of 1.41% in the past 24 hours, even though the overall market is down. This small rise does little to offset the significant losses faced by investors.

Why It Matters

The actions of major holders show how volatile meme coins and the broader crypto market can be. When big players make large trades, it can cause significant price changes and affect the liquidity of the asset.

The current drop in cryptocurrency prices has made the situation worse. Many tokens, including PEPE, have seen their values fall sharply, leading to heavy losses for investors. Although the whale still holds a large amount of PEPE tokens, the recent losses highlight how unpredictable these markets can be.

This situation serves as a reminder of the risks involved in investing in speculative assets. The influence of major holders on the market can be significant, and the volatility of meme coins like PEPE can lead to large financial swings. Investors should be careful and keep up with market trends and the actions of large players.

As the cryptocurrency market continues to face these challenges, the actions of large holders will likely remain a key point of interest for market watchers and investors. The drama surrounding the PEPE whale’s massive sell-off is just one example of how quickly fortunes can change in the world of digital assets.