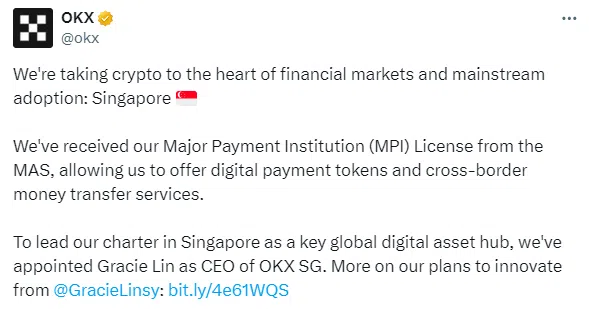

OKX Singapore (OKX SG), the Singapore branch of the global crypto exchange OKX, has just reached an important milestone. On September 2, 2024, they announced that they’ve officially been granted a full Major Payment Institution (MPI) license by the Monetary Authority of Singapore (MAS). This license, which was first approved in principle back in March, allows OKX SG to offer a variety of payment services. These include digital payment tokens, cross-border transfers, and cryptocurrency spot trading.

This MPI license is a huge win for OKX SG. It represents a big leap forward for the company, enabling them to offer more services and better meet their customers’ needs. With this approval, OKX SG is well-positioned to play a bigger role in the world of digital assets.

In another significant development, OKX SG has appointed Gracie Lin as their new CEO. Lin has a solid track record in finance and regulation. She worked at MAS from 2005 to 2015, where she held important roles such as deputy director and head of money markets. Lin also has experience from her time at GIC and Grab, where she focused on strategy and economics. Her background makes her an excellent choice to lead OKX SG.

Gracie Lin is thrilled about the MPI license. She said, “The MPI license is a major milestone for us. We are more committed than ever to providing access to digital assets for our customers and to supporting the community and the ecosystem.” Her appointment is a smart decision for OKX as they look to benefit from her expertise in navigating regulations and growing the company.

This MPI license and Lin’s new role come as OKX continues to expand its presence globally. Recently, the company has started new ventures in several markets. In May, OKX began offering spot trading and derivatives services in Australia. In June, they launched a crypto trading service and Web3 wallet in the Netherlands. OKX has also chosen Malta as their base for meeting EU regulations on crypto-assets.

At the same time, OKX has made some strategic changes. They’ve decided to withdraw their application for a Virtual Asset Service Provider (VASP) license in Hong Kong and stop their operations there. While the company hasn’t provided specific reasons for this decision, it’s seen as a part of their broader strategy to fine-tune their global approach.