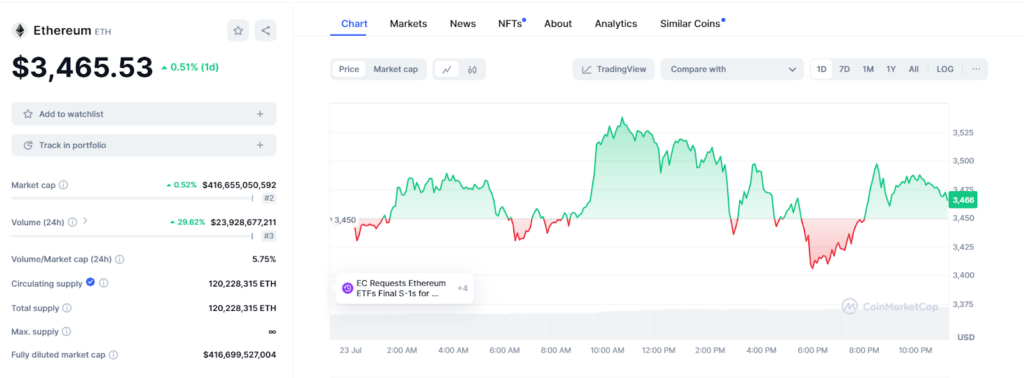

A new Ethereum exchange-traded fund (ETF) recorded $1 billion in trading volume just 24 hours after it was approved. This surge in ETF trading didn’t significantly affect Ethereum’s price, which remained stable throughout the day. As of now, Ethereum is trading at $3,465, showing only a 0.50% increase in the past 24 hours despite the ETF launch. This suggests that while there is strong interest in Ethereum investment products, it has not yet significantly impacted the cryptocurrency’s market price.

According to Yahoo Finance, Grayscale’s Ethereum Trust (ETHE) led the trading activity with $461 million in shares bought and sold. BlackRock’s iShares Ether Trust (ETHA) followed with $244.7 million in trades. Fidelity’s Ethereum Fund (FETH) was third with $138.5 million in trading volume.

Other funds also saw significant trading activity. Bitwise’s Ethereum Fund (ETHW) nearly reached $100 million in trades, while VanEck’s fund had about $45 million. Grayscale’s mini ETH ETF (ETH) handled $63.8 million in trades. Smaller funds from Franklin Templeton, Invesco, and 21 Shares saw less trading, ranging from $8.6 million to $15.9 million.

James Seyffart, an ETF analyst at Bloomberg, had predicted that these funds would attract between $125 million and $325 million on their first day. He mentioned that the final numbers would depend on how many investors the firms had lined up in advance. However, specific figures on the money flowing in and out of each fund are not yet disclosed.

While the Ethereum ETFs had a strong debut, they didn’t reach the impressive $4.5 billion in trades seen when Bitcoin ETFs launched in January. Experts had anticipated this difference, given that Ethereum has a smaller market cap compared to Bitcoin.

Overall, the launch of Ethereum ETFs marks a significant milestone in the cryptocurrency investment world. The strong initial trading volume shows that there is substantial interest in these new investment products. As more investors turn to Ethereum ETFs, we might see more impact on Ethereum’s market price in the future.

Read also: Crypto Asset Regulations for Banks Delayed to 2026