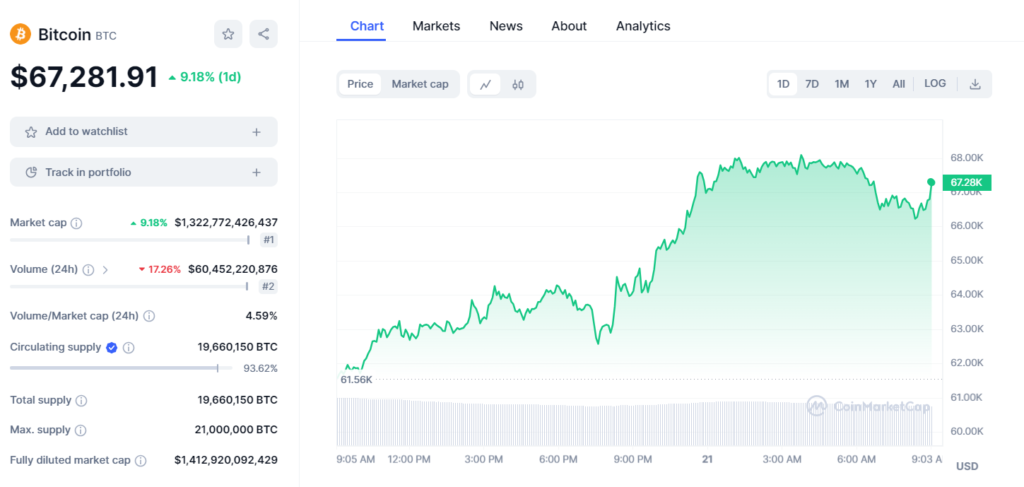

Cryptocurrency markets saw a strong comeback on Wednesday following U.S. Federal Reserve Chair Jerome Powell’s dovish statement in response to the central bank’s decision to stick with its prediction of three rate cuts this year. Bitcoin (BTC) is now close to $67,000.

BTC held steady at just than $67 early Thursday, holding the gains from the Fed-driven increase. Investors are drawn to the bitcoin market’s potential to resist macroeconomic challenges.

Bitcoin surged by more than 10% from its previous levels, reaching a day high of $67,781. Ether (ETH) also recovered from a 6% drop caused by reports that the SEC was considering classifying the commodity as a security and that the Ethereum Foundation was the subject of a covert government inquiry.

Over the preceding week, cryptocurrencycurrency values fell sharply, with Bitcoin experiencing its largest daily loss. Investors became apprehensive ahead of the Fed’s announcement, concerned that the recent surge in inflation would have an influence on rate cuts.

Two other prominent cryptocurrencycurrencies, Litecoin (LTC) and Dogecoin (DOGE), led the cryptocurrencycurrency market’s growth. The S&P 500 index reached a new all-time high, while the Nasdaq-100 gained 1.3%. Traditional markets also rallied. The US dollar index (DXY) declined more than 0.7% off its session high, indicating an increase in investor risk appetite.

The FOMC did conclude that policymakers should maintain current interest rates and make plans to cut rates in order to reduce the risk of a hawkish situation and relieve pressure on asset values. Powell stated during a news conference that, despite the higher inflation numbers, “we are making good progress on bringing inflation down.”

Read also: Marathon CEO Says Bitcoin Halving Effect Already Factored In