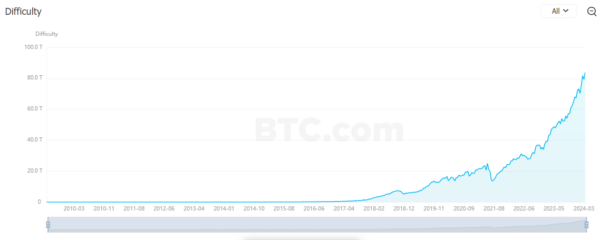

The mining difficulty of Bitcoin, the first decentralized cryptocurrencycurrency, peaked at 83.95 trillion hashes and hit an all-time high of $73,835. This difficulty highlights the difficulties that miners have when attempting to solve cryptocurrencygraphic challenges as a result of the growing network involvement.

There is increasing miner activity, as seen by the difficulty rise of 5.8% since the last measurement, which happened at a rate of 613.94 exahashes per second (EH/s). By March 27, it is estimated that the issue would have 84.17 trillion hashes.

The price movement of bitcoin has also been noteworthy; on March 11, incentives for miners reached a peak of $78.89 million, the most since October 2021. This increase corresponds with Bitcoin’s climb to $73,835 and subsequent minor decline.

The impending halving event in mid-April, when mining rewards will be halved from 6.25 BTC to 3.125 BTC—a procedure that has historically affected supply dynamics and investor sentiment—is how market analysts see the rise of Bitcoin.

The combination of the newly reached price top for Bitcoin and the record-high mining difficulty shows how resilient the cryptocurrencycurrency is to market and regulatory turbulence, which in turn draws in an increasing number of users.