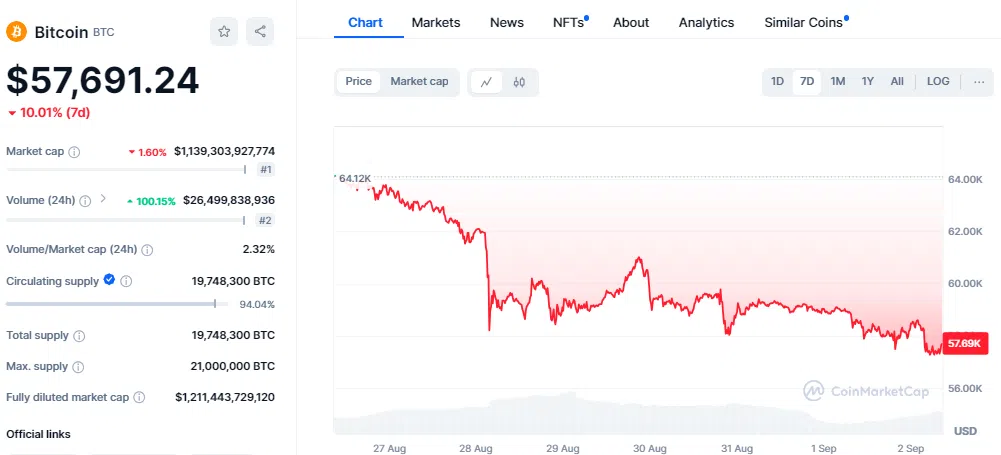

Bitcoin (BTC) is facing a tough beginning in September after already dropping 10% in August. The cryptocurrency is currently valued at about $57,270, marking its lowest point in two weeks. This price was last seen in mid-August, highlighting the strong selling pressure on the market. Other cryptocurrencies, known as altcoins, are also struggling, with many losing the gains they made recently. In general, traders and investors are feeling cautious as they closely watch to see how Bitcoin will perform next.

Critical Support Levels in Focus

Bitcoin’s recent drop has made people nervous about what’s ahead. Right now, all eyes are on the $55,724 support level. If Bitcoin falls below this, it could slide further to around $49,000, which would be a significant drop. This possibility is making investors uneasy.

Part of the problem is that institutional investors seem to be losing interest. For example, BlackRock’s iShares Bitcoin Trust has seen money flow out for the second time since it started. This suggests that big players are pulling back, at least for now. These outflows are adding to the selling pressure and making it harder for Bitcoin to bounce back.

Adding to the uncertainty is the looming possibility of a massive Bitcoin sell-off by the U.S. government and other entities. There are talks of the government selling off $14 billion worth of Bitcoin, including some from the old Mt. Gox exchange. If this happens, it could flood the market with more Bitcoin, driving prices down even further.

The Fed’s Role and Market Uncertainty

Even with all this going on, there’s still a bit of hope. Some people think that the U.S. Federal Reserve might cut interest rates on September 18, which could be a big help. The FedWatch Tool shows there’s a 30% chance of a 50 basis point rate cut. If this happens, it might spark a rally in riskier assets like Bitcoin.

But time is running out for those hoping for a recovery. The bulls, or those betting on Bitcoin’s rise, need to push the price back above its moving averages to start a real recovery. If they can do that, Bitcoin might climb up to $65,000 or even hit $70,000. However, the focus right now is on whether Bitcoin can stay above key support levels. If it doesn’t, the price could drop further, with the next major support at $54,000.

September is often a tough month for Bitcoin, with average losses of around 4.5%. This year seems to be following that trend. Traders are bracing for more ups and downs, with some expecting a possible short squeeze that could push the price up to $61,300.

What’s Next for Bitcoin?

Bitcoin’s recent struggles are tied to broader worries in the market. The drop is due to a mix of technical factors, changes in institutional interest, and concerns about what the government might do. The possibility of a big Bitcoin sell-off by the U.S. government adds another layer of uncertainty.

On the bright side, the upcoming 2024 halving event and the potential approval of spot Bitcoin ETFs in the U.S. could boost the market. But for now, things are uncertain. Everyone is watching to see if Bitcoin can hold above important support levels in the coming weeks.