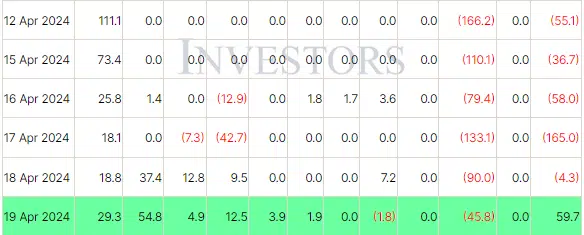

According to Farside Investors, investments in Bitcoin ETFs in the US reversed five days of outflows with $59.7M inflows on April 19, led by FBTC’s $54.8M gain. This was amid expectations of a post-halving value spike.

This upward trend is in contrast to earlier withdrawals, which were mostly from the Grayscale Bitcoin Trust ETF (GBTC), as a result of spot Bitcoin ETFs receiving SEC approval. The Bitwise Bitcoin ETF (BITB), ARK 21Shares Bitcoin ETF (ARKB), Invesco Galaxy Bitcoin ETF (BTCO), and Franklin Bitcoin ETF (EZBC) were the sources of notable inflows.

Following the halving, investors’ increasing investments in Bitcoin ETFs indicate a bullish outlook, indicating confidence in the cryptocurrencycurrency’s potential for development.

After the last halving in 2020, the price of Bitcoin shot up from $8,500 to over $65,000 in just four years. This spike in ETF investments suggests that investors are still optimistic about Bitcoin’s future growth, even after its halving.

Read also: Bitcoin Mining Difficulty Hits 80 Trillion Ahead of Halving Event