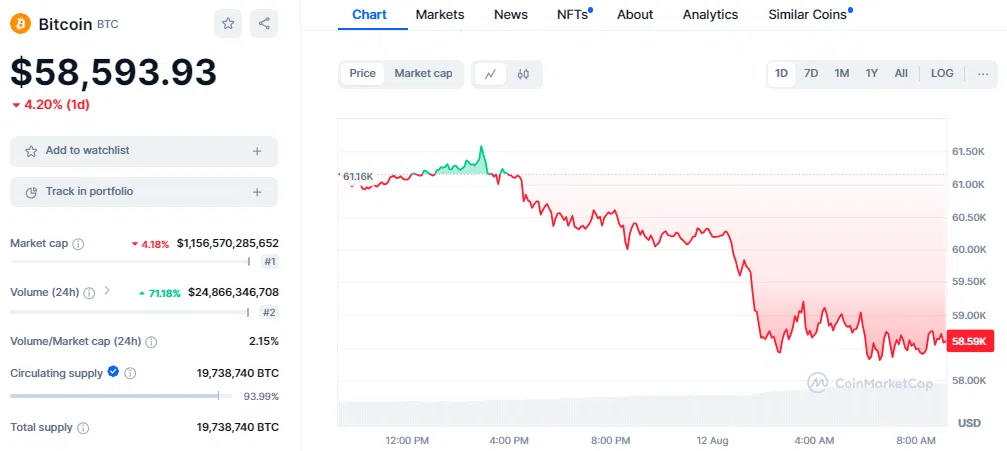

Bitcoin, the world’s largest cryptocurrency, dropped below $59,000. This happened after it held steady above $60,000 for four days. The cryptocurrency reached a low of $58,269, down from a high of $61,562 earlier in the day. Over the past 24 hours, Bitcoin fell by 6.7%, adding to a 13.9% loss over the last two weeks.

The broader cryptocurrency market also faced losses. The total market value dropped by 3.18%, falling to $2.05 trillion. Global trading volume increased by 7.53%, but overall trading activity remained lower than in previous weeks. Ethereum (ETH), the second-largest cryptocurrency, followed a similar pattern. ETH dropped from a high of $2,720 to a low of $2,527 before settling at $2,553.

Market-Wide Liquidations Hit Hard

The market’s recent downturn caused a spike in liquidations. According to Coinglass, 67,883 traders were liquidated in the past 24 hours, totaling $174.38 million. Of this, $134.18 million came from long positions. Bitcoin led the way with $41.31 million in liquidations, followed by Ethereum, which saw $33.8 million in losses.

Other major cryptocurrencies also suffered significant declines. Toncoin (TON) fell by 8.66%, while XRP and Solana (SOL) dropped by 6.5% and 5.73%, respectively. As the day continued, selling pressure increased, leading to more market volatility.

The largest single liquidation occurred on the OKX exchange, where an Ethereum trade resulted in a $2.17 million loss. Although trading volume increased, the drop in prices and the rise in liquidations show that market sentiment remains bearish. Investors are cautious as the cryptocurrency market continues to experience high volatility.

Analysts believe Bitcoin could recover in the coming months if the U.S. economy avoids a recession. However, given the current market conditions, investors should remain careful.