Crypto venture capital funding has risen above $1 billion this year for the second consecutive month in an exciting run of success. Closely trailing March’s record-breaking $1.09 billion from 186 rounds, April saw a remarkable $1.02 billion flood into the business through 161 investment rounds.

One of the most notable fundraising events they attended was the $47 million investment made by Blackrock in Securitize, a company that pioneered real-world asset tokenization.

This is a huge accomplishment, reminding me of the successful funding run from October to November of 2022.

Furthermore, Monad, a layer-1 blockchain that was predicted to be a “Solana killer,” was backed with an impressive $225 million by Paradigm and Coinbase Ventures.

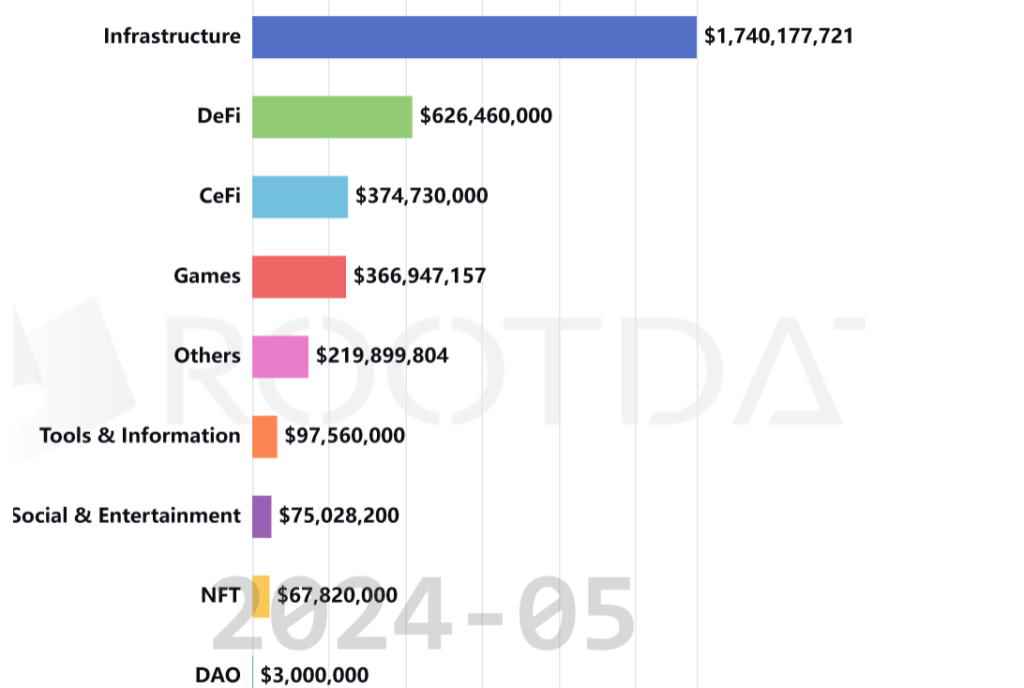

Remarkably, just a meager $3 million has been secured by decentralized autonomous organizations in 2024.

Infrastructure Firms Lead, DeFi Protocols Follow

With a stunning $1.7 billion in venture capital funding, blockchain infrastructure firms have emerged as the biggest winners this year, closely followed by decentralized financial protocols at $626 million.

2024 is expected to surpass the astounding $9.3 billion raised in 2023, with almost $3.67 billion already put into the market through 604 fundraising rounds.

Through 5,195 investment rounds since June 2014, the total amount of money invested in the blockchain sector has already surpassed an incredible $100 billion, according to DeFiLlama.

Also Read: Japan Facilitates VC Investments in Crypto and Web3 Technology