According to Bloomberg ETF researcher Eric Balchunas, Spot Bitcoin exchange-traded funds (ETFs) had a trading volume rise in March, exceeding $111 billion, nearly tripling that of February.

BlackRock’s IBIT Bitcoin ETF led trading volume, followed by Grayscale’s GBTC and Fidelity’s FBTC. IBIT’s market share overtook GBTC’s, indicating a growing interest in spot Bitcoin ETFs.

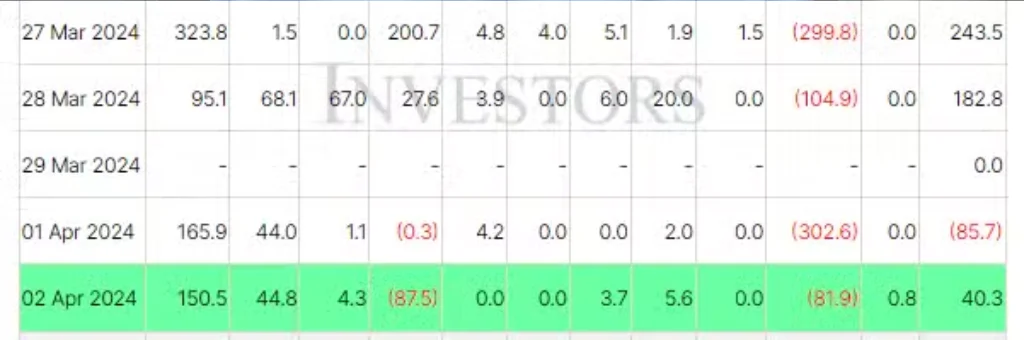

On April 1, spot Bitcoin ETFs saw a net outflow of $85.7 million. Grayscale experienced withdrawals of $302.6 million, while BlackRock’s IBIT received inflows of $165.9 million. Fidelity’s FBTC saw $44 million in inflows, while the ARK Invest 21Shares ETF ARKB experienced small withdrawals.

In March, BlackRock and Fidelity’s ETFs attained assets of around $18 billion and $10 billion, respectively, thanks to significant inflows. In contrast, Grayscale’s GBTC had huge withdrawals, reducing assets by 46% to $22 million.

Spot Bitcoin ETFs have had an impact on BTC markets, helping to drive fresh all-time highs in March. Analysts foresee a new cycle that combines ETF success with the forthcoming Bitcoin supply halving, which is less than 20 days away.

This news emphasizes the importance of spot Bitcoin ETFs in the evolution of the cryptocurrencycurrency market, namely BlackRock’s dominance and the influence of recent inflows and withdrawals.